Jify - On demand Salary Loan | Jify Instant Personal Loan App | Jify Loan App Reviews 2024

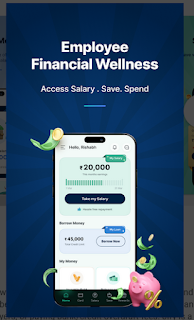

What is Jify - On demand Salary Loan?

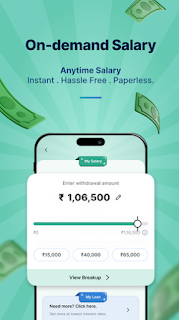

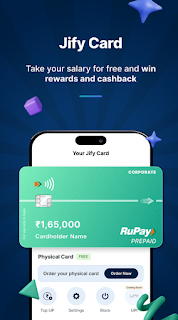

Jify - On demand Salary Loan is one of the largest financial wellness platforms for the employed workforce in India. We are the leader in on-demand pay. We allow employees to access their earned salary instantly and before the month-end pay cheque. With Jify, you can avoid paying high-cost interest charges, borrowing from friends/family/employers, or bank/credit overdraft fees. Jify is a platform facilitating salary access earned on CreditLine through our NBFC Partners – NDX P2P Private Limited (“LiquiLoans”) and K.M. Global Credit Private Limited (“Credit Fair”) – both RBI-regulated entities.

Who can use Jify - On demand Salary Loan?

Jify’s earned salary access is available to

employees from partner organizations only. Users must be Indian

residents and actively working with our partners.

Why Jify - On demand Salary Loan?

• Hand-picked by your HR leaders to offer long-term financial wellness

• You have 0% interest/fee and instant access to your pay as you need

• One-time KYC.

• Easy to use, with no paperwork or document upload required except KYC.

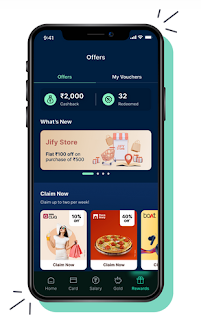

• Multiple rewards and benefits

• Available to all employees in an organization

• Available 24x7, withdraw your salary when you need the money

Jify - On demand Salary Loan/Salary advance/ on-demand salary - want to know more?

You

have been working on your money management, but perhaps you went a

little bit over budget for the month. The electricity bill is due on

Monday, but you won’t get paid till Friday. You're set to overdraft if

money doesn't hit your account soon. This is where Jify comes in to help

you take your OWN earned salary when you need it. Think of it as a

parachute, helping you land safely at the end of the month.

For

example, if you were last paid on Day 15 of Month 1, and you need money

on Day 25 of Month 1, you use Jify to access your earned salary for 10

days of hard work.

|

| Jify - On demand Salary Loan | Jify Instant Personal Loan App | Jify Loan App Reviews 2024 |

Jify - On demand Salary Loan Fees and Charges

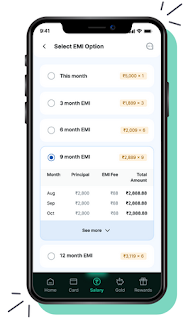

Jify offers salary on a

credit line to employees. Users can withdraw upto 3X of monthly salary

from this limit and repay over a period of 3 months to 12 months each

time they make a withdrawal. Annual Percentage Rate (APR): Ranges from 8

- 36%. APR is communicated on the Jify App upfront before accepting the

offer.

Jify - On demand Salary Loan Transaction Breakup - Example

* Loan Amount: ₹ 100000

* Minimum repayment period: 3 months

* Maximum repayment period: 12 months

* Interest rate: 0.75% per month

* Processing Fee: ₹ 258

* Interest: ₹ 2250 (calculated on a yearly basis and on a reducing balance basis)

* APR: 17.45%

* Amount that gets deducted from your salary: ₹ 102657

ads3

|

| Jify - On demand Salary Loan | Jify Instant Personal Loan App | Jify Loan App Reviews 2024 |

Jify - On demand Salary Loan App Permissions that we seek:

One-time permissions like location, microphone, to have data points to enable processes such as KYC.

For a faster process, we typically require the following permissions:

Location - To check and expedite the KYC process

Camera & Microphone - Helps to upload selfie video for the application process.

Safety & Security (Data Protection)

Data Security Features

Jify is ISO 27001:2013 certified

Data at rest and in transit is 100% encrypted.

Customer data is stored & processed only in India

Privacy Policy: https://www.jify.co/privacy-policy

Terms & Conditions: https://www.jify.co/terms-and-conditions

To get in touch, you can reach out at support@jify.co or (+91)9820048614.

New Jify Instant Loan App without Income Proof Rs 2,00,000 Loan for 36 Months With Proof #jifyloan

0 Comments

Please Do not enter any spam link in the comment box.