Finnov Partner: Sell Loans/DSA : What is a Direct Selling Agent (DSA) and how does it work?

%20and%20How%20it%20works.png) |

| Finnov Partner: Sell Loans/DSA : What is a Direct Selling Agent (DSA) and how does it work? |

Start Your Own Credit Card, Personal Loan, Insurance Business

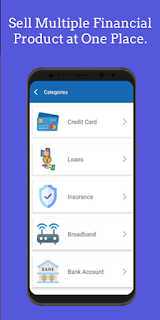

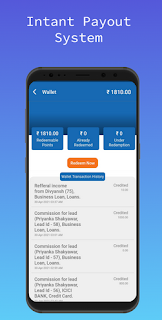

The Finnov Partner App Helps You To Sell Multiple Financial Products At One Place. With Instant Payout System in the Industry. You Can Earn More Than ₹50,000 Every Month.

Start your own business with zero investment and earn more than Rs 50 thousand every month.

about us.

We make personal finance simple, fair and transparent. We help customers choose the best financial products using data and technological advancements.

Digitally guide your customers on credit card and loan applications and simplify personal finance.

Finnov Partner App helps you sell multiple financial products at one place with the fastest payment system in the industry.

Finnov partner app is known in the industry for hassle-free work and quick payment system. It helps you to earn extra money without interrupting your work. You can start your business with Finnov and earn more than ₹50,000 every month through Finnov Partner App.

|

| Finnov Partner: Sell Loans/DSA : What is a Direct Selling Agent (DSA) and how does it work? |

Finnov partner app India is an official distribution / referral partner for personal loan / credit line products of the following RBI approved banks and NBFCs: Lendingkart Finance Limited (formerly known as Adri Infin Limited)

Visit: https://www.lendingkart.com/dsachannelpartner-xlr8/

Products: You can sell personal loans, business loans, home loans, credit cards, insurance by generating leads.

How does Finnov India work?

Finnov Partner: Sell Loans/DSA : What is a Direct Selling Agent (DSA) and how does it work?

Finnov India team is working on qualified and interested customer leads. Simply create a lead and sit back, relax.

Why become a partner?

1) Zero investment required

2) All India Business Opportunities.

3) India First Instant Payout Provider App.

3) Work can be done from home through Finnov Partner App.

4) Build your own network and generate lifetime passive income.

5) Assistance to grow your business within time.

6) Engage your customers with marketing posters.

Why hassle free work and how to earn money?

In this app all you need to do is generate leads from the person who is eligible and interested in financial products like credit cards, loans, personal loans, business loans, insurance and other financial products. Then our team will work on it and help your customer get the best financial product.

features-

1) You can track your lead status live in the app.

2) You can easily manage your wallet money in the app.

3) More than 50 banks and NBFC products available.

4) Easy to manage app

5) 100% data security

Who can use this app?

Finnov Partner App can be used by financial advisors, loan agents, credit card DSAs, loan partners, businessmen, self-employed, insurance agents, salaried individuals, housewives and students. And those who are interested in starting a career in selling financial products such as insurance, loans and credit cards.

Lifetime passive income opportunity-

You can build your team by referring Finnov Partner App, you will get lifetime 2% income from the income from selling products of your referees.

Note: personal loan

Loan Repayment period – 3 months to 5 years

Personal loan interest rates can vary from 10.99% to 35% per annum depending on the customer profile and bank/lender requirements. Loan processing fees may vary from 1% to 3%.

Example – Personal loan of ₹3 lakh at an interest rate of 15% per annum. With a repayment tenure of 3 years, the EMI will be ₹10,400 per month.

|

| Finnov Partner: Sell Loans/DSA : What is a Direct Selling Agent (DSA) and how does it work? |

- Total interest charges: ₹74,386

- Loan Processing Fee (@including 2% GST): ₹6,000

- Total cost of loan: ₹3,80,386 (including applicable taxes)

- In case of change in payment mode or any delay or non-payment of EMI, additional charges/penal charges depending on the policy of the lender, pre-payment programs may also be applicable.

For any assistance, call +91-7909408308 or write to support@finnovindia.com

More Explaination:-

If you are applying for a loan, you can apply for it directly at an NBFC or bank, or you can apply for it through agents called DSA (Direct Selling Agent).

Who are Direct Selling Agents (DSA)

Full name of DSA is Direct Selling Agent. The job of a DSA is to find potential customers for the bank or NBFC they represent. DSA is looking for people interested in taking loan and will guide them through the process.

DSA connects borrowers with the lender and takes care of all the documents required for the loan application. DSAs also carry out checks and due diligence to ensure that the documents provided are genuine.

They are paid for the effort they do for both the borrower and the lender. The payment they receive is a percentage of the loan amount, and this percentage depends on the type of loan sanctioned. In some areas, especially rural areas, these DSAs are also known as business correspondents. And in both rural and urban areas it is a great and efficient way to earn some extra money.

What do DSAs do?

DSAs not only connect borrowers to lenders but they also perform many other important functions, such as –

- Collecting all the important documents and loan application form from the borrower carefully and with effort.

- Performing due diligence and checking to ensure that the loan application and other documents are correct.

- Ensuring that the documents provided by the lender to the borrower are genuine and not forged documents.

All these documents have to be collected and submitted along with the loan application form and provide your DSA code to the DSA so that the application can be traced.

Benefits of becoming a DSA

There are many benefits of becoming a DSA. DSA plays an important role in the lending ecosystem. A DSA helps banks and NBFCs find suitable borrowers. A DSA helps borrowers find a suitable bank that is willing to lend them money. And finally, it helps them to earn money for themselves. And nowadays anyone can become a DSA: a housewife, a working professional, a self-employed, etc., and they can earn extra money too.

Other benefits of having a DSA are –

|

| Finnov Partner: Sell Loans/DSA : What is a Direct Selling Agent (DSA) and how does it work? |

- You can work when you want as DSA works on flexible hours.

- As a DSA you have to be your own boss.

- You can earn good payments in the form of commission on the leads you generate.

- By becoming a DSA, you are becoming a part of the financial industry and credit industry, and these industries are one of the important industries of any economy.

- You can earn side or side income by becoming a DSA. You don't have to leave your current job, you can do these part-time jobs.

- You can run this business without any risk, and this business also does not cost much. You can work at minimum cost.

- You do not need any higher educational qualification or special degree to become a DSA.

- The bank or NBFC will also provide you with the necessary training.

- You just need to send the lead that you have generated to the bank or NBFC and the rest of the financial and technical work will be done by the bank/NBFC.

- In some NBFCs, no investment or deposit is required to become a DSA.

DSA Registration Process

Different banks/NBFCs have different registration procedures. But this is the general procedure to apply –

- Visit the particular bank/NBFC and submit your application to the bank/NBFC

- Make payment if necessary.

- After you make the payment the bank/NBFC will contact you and will be asked to submit certain documents.

- After you submit your documents, they will verify them, and a legal team will do the due diligence process, and your CIBIL score and credit history will be checked.

- After verification and due diligence, if they do not find any issues, a DSA registration agreement with the correct stamp duty will be handed over to you.

- Now you have to fill some required details, then sign the agreement and submit.

- A DSA code will be issued by the bank or NBFC.

- Once you receive the DSA code, you can start uploading and submitting the loan application and loan documents.

:-FINN51287

Apk Download Link :- Click Here

.png)

%20and%20How%20it%20works.png)

0 Comments

Please Do not enter any spam link in the comment box.