FINSARA Loan App Review 2024 - Get Instant Loan from FINSARA Loan App? Finsara apk Download Now

|

| FINSARA Loan App Review 2024 - Get Instant Loan from FINSARA Loan App? Finsara apk Download |

FINSARA Loan App Review 2024

In today's fast-changing world, we are often faced with sudden financial needs during times of absence. In such times, taking the help of loan to solve one's financial problems has become a common concept. However, obtaining a loan and paying it back systematically can be a challenging task. For this reason, apps like FFINSARA Loan App Review 2024 can make an important contribution in improving the ease and usefulness of taking a loan.

|

| FINSARA Loan App Review 2024 - Get Instant Loan from FINSARA Loan App? Finsara apk Download |

What is FINSARA Loan App Review 2024? How much loan can one get from here? For how long can a loan be availed from FINSARA Loan App? At what interest rate can one get loan from FINSARA Loan App? How to take loan from FINSARA Loan App? We will provide you all the information in today's post.

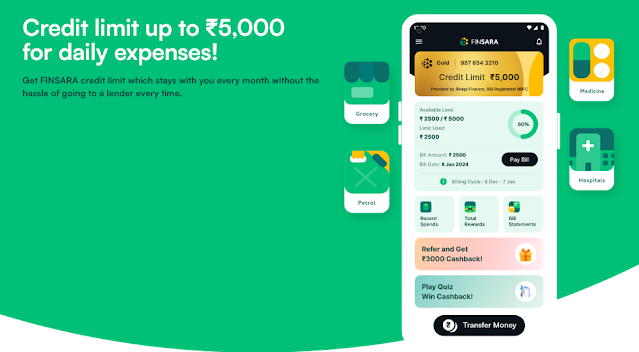

What is FINSARA Loan App Review 2024 Credit Limit?

FINSARA Credit Limit is an app that provides you easy financial solutions for your daily expenses. It provides you loans for everything from your grocery store to medical store and even petrol pump. Once you're approved at FINSARA Loan App Review 2024, you can transfer money to your bank account and grow your credit history. FINSARA is currently available in 200 cities – Delhi-NCR, Indore, Haridwar, Pune, Ahmedabad, Rajkot, Mumbai etc.

FINSARA Loan App Benefits

- 100% paper free process and get credit limit in 5 minutes.

- No Hidden Charges: FINSARA Loan App Review 2024 does not surprise you with any hidden charges.

- No Security Deposit: FINSARA Loan App just requests proof of income and employment, that's it.

- Pay only when you use FINSARA: Monthly fee only when you use FINSARA ranges from ₹79 to ₹299, depending on your credit limit.

- Get a Personal Loan: Make payments on time and be eligible for a personal loan up to Rs 1 lakh.

- 100% Secure: All data collected on the FINSARA app is secured with our RBI registered lending partners.

FINSARA Loan App Review 2024 - Get Instant Loan from FINSARA Loan App? Finsara apk Download

How much loan amount is available from FINSARA Loan App Review 2024?

FINSARA Loan App Review 2024 you can take a loan ranging from ₹ 10,000 to ₹ 1,00,000. If you want to apply for a loan, you can get a minimum loan of ₹10,000. You will also get a loan of ₹ 1,00,000 from this application.

What is the loan interest rate on FINSARA Loan App Review 2024?

If you take a loan from FINSARA Loan App, then you will get interest at the rate of 16% to 36% per annum on this app and will have to pay interest on the loan amount. Through this application you can get a loan at an interest rate of at least 16%. From here you can get a loan at a maximum interest of 36%.

For how long can a loan be availed on FINSARA Loan App Review 2024?

From FINSARA Loan App Review 2024 you can take loan for 4 to 6 months. You can get a loan from here for at least 4 months. You can get loan for maximum 6 months.

|

| FINSARA Loan App Review 2024 - Get Instant Loan from FINSARA Loan App? Finsara apk Download |

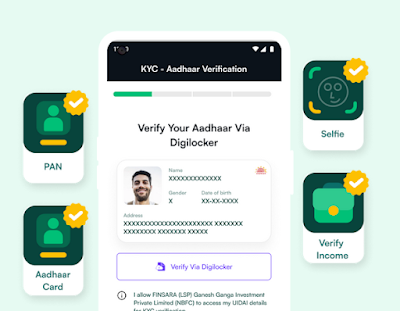

What are the important documents for FINSARA Loan App Review 2024?

- PAN card

- Aadhar card

- bank account

- selfie

Who is eligible to take loan from FINSARA Loan App Review 2024?

- You must be 20 years of age or older.

- You must have PAN card.

- Your phone number should be linked to Aadhaar.

- Must have UPI enabled apps like Google Pay, PhonePe, Paytm etc.

- Your minimum monthly salary should be ₹15,000.

- Your minimum annual household income must be more than ₹300,000.

How to apply for loan on FINSARA Loan App?

ads5

- First of all you have to install FINSARA Loan App Review 2024 from Play Store.

- After this you have to click on the option of Register With Phone Number.

- Now you have to enter your phone number.

- Now an OTP will come on your phone number, that OTP will have to be entered there.

- After doing all this you will see the loan option below, click on it and click on Start Your Application button.

- Now after filling the tile of your basic, you have to click on the option of Continue.

- Now it will ask you for a selfie, submit it.

- You will be asked for basic information and FINSARA Loan App will check your credit score.

What things should be kept in mind before using FINSARA Loan App Review 2024?

- When the bill is generated on 8th, you have to make the payment by 12th using any UPI application like GooglePay, PayTM, PhonePe.

- Interest Rates: If you do not make payments within the due date, you start charging higher interest rates. FINSARA's interest rates can range from 16% to 36%, which is quite high.

- Hidden fees: Many times there are some hidden fees in apps, about which users are not fully aware. Therefore, it is important to read all the terms and conditions carefully before using FINSARA.

- Like gambling: Some people believe that the “pay later” facility encourages people to spend more than their income, which can lead to financial problems. Therefore, FINSARA should be used with caution

Finsara Loan Apply Process With Live Proof

FINSARA Loan App Review 2024 can be an option for those who have not yet built a credit history or can be helpful for those with a weak credit history. However, it is important to keep in mind the risks of higher interest rates, shorter repayment tenure, lower loan amount and being a new app. Also, it is important to note that there are many other loan apps available in the market, which need to be compared and choose the most suitable option for yourself.

0 Comments

Please Do not enter any spam link in the comment box.