Zolve US Credit Card Review - US Credit Cards Without a Social Security Number Open a Credit Card, Open a Zolve US Bank Account Online from India

Zolvay from India to the US (or the other way around) has launched a US credit card for Indian individuals known as the Zolve US credit card. There is no joining and annual fee in this credit card. Here's everything you need to know about it.

New Delhi: A Neobank, Zolve on Wednesday announced the launch of financial products that provide bank accounts, credit cards and debit cards to people without a social security number when they enter the US. The Federal Deposit Insurance Corporation (FDIC) provides insured bank accounts, as well as other services provided by Community Federal Savings Bank (CFSB) to immigrants who are Zolve customers.

Zolve has created an opportunity for US expatriates to begin building their financial future in the US, a statement said.

First, the product suite includes mobile apps, MasterCard operated credit cards, FDIC insurance up to USD 250,000 with no minimum balance requirement and no social security number required to apply, it said.

Zolve was launched in beta in August 2021 and has seen over 42,000 registered customers since then.

“Let us tell you that the Zolvay is designed to level the playing field for international students and working professionals as well, combined by providing these essential toolsets to fulfill your very own American dream. The states are trying their best to come to America

Raghunandan, CEO, Zolway, said, “Our mission is to transcend borders and create a financial world with equal access to high quality banking facility and products for global citizens of every country.”

Before Zolve, American immigrants weren't able to get a bank account or credit card without waiting months, sometimes years, to establish credit or get a Social Security number, he said.

Going forward, the company is looking to expand its reach to other countries such as Australia, Canada, Germany and the UK, he said.

Ten thousand Indian students and professionals move out of India for better higher education and work. The primary problem Indian students and professionals face is the savings account and the U.S. economy. open credit card.

US Banks in or in most other countries only issue credit cards based on credit scores issued by local credit score providers. Even if you have a good credit score (CIBIL above 780) in India, this credit score will help you in the U.S. Credit card will be required.

Zolve. About this

Zolve is a Bengaluru and San Francisco-based global neo-bank that aims to facilitate transactions across financial systems and borders. The startup has already grabbed $15 million in seed funding.

Zolve credit card benefits,

MUMBAI: A neobanking startup, Zolve has tied up with US-based Community Federal Savings Bank (CFSB) to provide credit cards to Indians traveling to the US for higher studies or employment. Such persons may have a credit history in India, but none in the US. Zolve aims to use this credit history and other parameters to issue the card.

Zolve will also open a bank account for its users before actually moving to the US. The card is sent to the users upon their arrival.

“Usually banks in the US require a social security number to issue a credit card to a customer and it takes 2-3 months to obtain it. However, what is not widely understood is that a US visa is also a valid ID proof for this purpose and that is what we do.

Customers must provide a US address within 90 days of opening a bank account. “Credit cards have a standard interest-free period of 1 month. For those who pay the minimum amount due, there is an interest-free period of 6 months on the balance and after that the interest begins to accrue. Allows to pay earlier It also lowers the premium," he said.

The spread and fees of foreign exchange take a toll on Indian immigrants and students in the US. Raghunandan said Zolve is working with an Indian bank to secure a favorable deal for its customers. Bank account, debit and credit cards are free, he said, with no minimum balance requirement. The merchant earns his revenue from the discount rates on the Zolve card

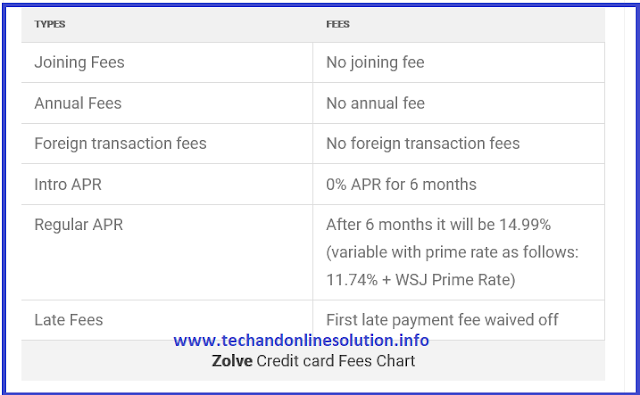

Zolve US Credit Fees and Rates

Zolve us credit high credit limit

The Zolve US credit card offers a higher credit limit, you can get a credit limit of up to $10,000/-, which would be a sufficient balance for students and professionals.

First late payment fee waived

First late payment will be waived, after which late fee will be charged

0% APR for 6 months

The Zolve credit card offers zero interest rate for the first 6 months as an introductory offer. You can use this 6 month build to set up life in a new country (USA Now only)

You can use this card to earn great reward points and get rewards points at select partner merchants like Amazon, Costco, by using this card with Zolv US credit card,

Freeze/Unfreeze option from app

You can control your credit card with the Credit app. You can freeze/unfreeze from the app

No SSN nor US No credit history required

You do not need an SSN nor a U.S. account for the Zolve credit card application. Credit history is not required. All US based credit providers are required to have an SSN or US credit card history for the application process.

its pre-approved credit card

When you add a Zolve credit card or bank with Zolve, you get pre-approved in India and get your card as soon as you land. How's that for being a priority?

No Security Deposit required

You don’t need a security deposit to get a high credit limit with Zolve

Help to Build great US Credit Score

The Zolve Card helps you build a great U.S. credit score from the time you arrive. Zolve report your payments to the U.S. credit bureau that will increase your FICO Score.

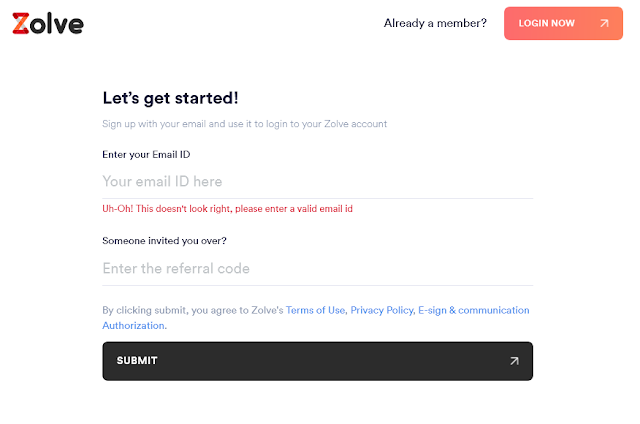

How to Apply for Zolve US Credit Card

You can apply Zolve US Credit Card by visiting Zolve official website that is https://zolve.com/ and sharing some information, Photo, Passport Copy etc..

Verdict: Should You Get the Zolve US Credit Card?

If you are a new immigrant from India to the US, you need to build up a US credit score to have a US credit card without any protection. However with the help of Zolve credit card you can get American credit card without SSN (Social Security Number) or US credit history.

You can sign up for a credit card and account from India itself. US Even before you land, you have your finances sorted out. Zolve has you covered from the start!

FAQ

Here are some frequently asked questions about the Zolve credit card taken from the official website.

When will you get the Zolve US Credit Card? Will you get it in India or in the USA?

The Zolve US Credit Card will be delivered to your USA address as per your travel plan.

Will you have credit history without SSN?

Yes, Zolve will help build US credit history without SSN.

0 Comments

Please Do not enter any spam link in the comment box.