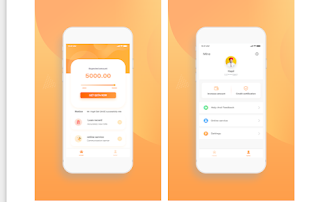

Personal Loan Apply Online Rs.15,000/- HiCash Loan App

Hi Cash is a personal loan application that is India's Most Prominent Instant Consumer Loan Provided loan service across India, it is a consumer loan that provides loan to worker people even if you are a salaried person or self employed. You can apply for a loan, through this online personal loan application, you can take a loan sitting at home,Talking about the minimum loan, you can get a loan limit ranging from ₹ 2000 to ₹ 15000, that too above the low interest rate, this is the financial situation because the banks provide this loan through the company,With this loan application, the loan process is digital, there is no need to send any physical document anywhere, you can apply for a loan from your smartphone from your home on top of some KYC document and instant loan amount transfer to your account. Can, this is India's number one application, it is registered with RBI, you can apply for loan within this application The consumer loans,

Hi cash features Loan

Applying the loan on Hi Cash is like this, if you apply loan within this application, 100% online paper less will be processed as well as you have to complete the minimum documentation, there is no credit history requirement, Along with this, you will also get the option to do multiple repayments, this is India's number one application, we should apply for a loan with this application. You can apply for instant loans online from your smartphone application at home. There is easy form application inside Hi app application, you can apply loan in easy way, there is no collectrol charge, you will get 100% paperless document to see inside this application, along with the minimum document Along with the application, it works all over India, providing loans, and while there, there is no requirement of credit history here.

Check Eligibility

Hi App It is very important to do some eligibility check before applying loan within this loan application, it is very important to be an Indian citizen to apply for loans within this application, as well as talk if you are above 18 years of age. Should be your source of income, only then you can take online loan sitting at home through this application, 100% is a real new application. It is a loan application working all over India. Only,

Document Required for Loan :- Hi Cash

Some important documents have to be submitted before applying a loan within the Hi Cash application, to apply for a loan we have to share some documents, talk about the document, as a document, you need to have an Aadhar card as address proof or Then you can give passport, you can give your PAN ID as an identity proof, in this case it may happen that you will be asked for office ID card if you If you work in any company or have any business, you can also be asked for a bank statement, Also, if you are doing any company or any business, then you can also ask for a valid email ID. If you complete all these documents, then you can take a loan online through your smartphone sitting at home. Are, 100% loan application it works and it provides loan to all the people all over India.

How to apply Loan :- Hi Cash

How to apply for a loan within the Hi Cash application, first the application has to download the Hi app from inside the Play Store, then register through your Facebook account or a mobile number, as well as some basic details. You have to share, after that your Eligibilty will know how much loan you should get,After that you will have to provide a KYC document in which you can give your Aadhaar card as address proof and you can give a PAN card as an identity proof, if your loan is approved then sign the loan agreement in your bank account Transfer loan amount,

For Example:-

Loan Amount: from ₹2,000 to 15,000.

Tenure: the short- term tenure is 91 days upto 365 days.

Interest rate: 36% per annum.

APR: 36%

Service fee: 0

Tenure: the short- term tenure is 91 days upto 365 days.

Interest rate: 36% per annum.

APR: 36%

Service fee: 0

Interest Calculation

For example, If the loan amount is ₹2,000 and interest rate is 36% per annum so with the tenure of 91 days, , the interest payable is as follows :

Interest rate = ₹2,000 * 36% / 365 * 91 = ₹180.

For example, If the loan amount is ₹2,000 and interest rate is 36% per annum so with the tenure of 91 days, , the interest payable is as follows :

Interest rate = ₹2,000 * 36% / 365 * 91 = ₹180.

Security & safe Data

Hi apps, if you apply a loan inside you, you upload any kind of data to apply for a loan within this application, then you can apply for launch here, your data will be safe and secure.

6 Comments

Getting Home Loans for Residents in Dubai, UAE is easy now.

ReplyDeleteCustomer Care helpline toll free number 7047602749.7047309283

DeleteCustomer Care helpline toll free number 7047602749.7047309283

Customer Care helpline toll free number 7047602749.7047309283

Thanks for the informative blog on personal loan in which you have shown the customers eligibility criteria. Also you can reach us at Personal Loan Providers in India

ReplyDeletefor more.

Thanks for sharing this beautiful blog with us. We have gone through your blog and get exciting information. If viewers looking for any money lending software or loan management software development then feel free to contact us.

ReplyDeletethanks for sharing a valuable information in your blog. please keep on posting

ReplyDeletedebt consolidation services in ontario

non profit credit counselling toronto

debt consolidation toronto

credit counselling toronto

debt relief toronto

loan consolidation Toronto

ReplyDeleteThank You For the Information. Keep Posting. Very Useful information.

Loan Management Software

Loan management system

loan software

lending software

loan servicing software

nbfc software

Please Do not enter any spam link in the comment box.