Paytail Reviews - BNPL fintech startup Paytail: Paytail is a digital lending platform app with the help of which you can get instant credit limit and make bill payment at any local shopping store in few easy steps to get this limit which you pay on time. You will see an increase in your CIBIL score and at the same time can fulfill your needs using this app in the shortest possible time.

What is Paytail?

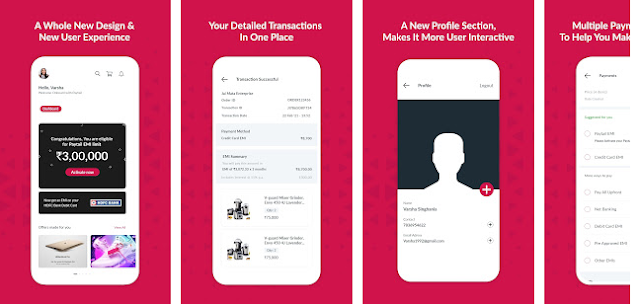

Paytail is India's fastest growing finance based commerce platform. Use this app to shop from nearby merchant stores and also get exciting EMI options and cashback offers.

Mostly it has been seen that when there is a delay in the arrival of the salary of the people, then they go towards the personal loan and want to fulfill their needs, in this case they can get the instant credit limit through the application and fulfill their needs. Can provides you the facility of giving you a loan from one side. The time taken for loan repayment ranges from 3 months to 12 months, it also depends on how much loan amount the customer is capable of making loan payments based on that.Paytail app- It is very easy to use

If there is an urgent need of money or there is a delay in the arrival of your salary, then in such a situation you can take the help of this application, with the help of which you can fulfill your needs, here you will get Newton from ₹ 3000 to ₹ 500000. Provides loan limit of up to Rs.10, which you can shop at any local store and pay your loan in installments in EMI.

*BNPL fintech startup Paytail on Thursday announced that it has raised $1.5 million from Cholamandalam and other marquee angel investors as part of its seed round. Chola's entry will further strengthen the capital supply on the platform, which is a key component required to grow the BNPL fintech business.

*Along with Cholamandalam, Paytail is committed to building a network of other large financial institutions to meet pre-approved loan offers for consumers. Maple Capital was the investment banker for this transaction while Strategy Law was the company's legal advisor.

*A company statement claimed that the startup is betting big on innovation to provide a seamless customer experience and drive sales on the merchant side.

*Along with Cholamandalam, Paytail is committed to building a network of other large financial institutions to meet pre-approved loan offers for consumers. Maple Capital was the investment banker for this transaction while Strategy Law was the company's legal advisor.

*A company statement claimed that the startup is betting big on innovation to provide a seamless customer experience and drive sales on the merchant side.

Want to finance your purchase? Use Paytail EMI

Eligible members (users) are offered instant loans through Paytail EMI - an instant line of credit offered through Paytm's partner lending institutions for your purchases.

Paytail - How much interest will be charged

If you use Paytail app, then you will have to pay minimum 18% to 25% annual interest. This is a digital lending platform app with the help of which you can get credit limit instantly and that limit can be easily increased to any local. Pay bills at the store and fulfill your needs.

Paytail app - What will be the loan payment timings

After taking the loan from this Paytail app, from when the loan will have to be paid, then tells you that the time period from 3 months to maximum 12 months is given, which will increase in your CIBIL score if you pay on time And your limits will also see an increase.

Let us tell you for the information that when you apply for a loan through this Paytail App, no advance is taken from you and no joining fee is charged from you, you can get instant credit limit without worry. And you can spend it anywhere to the limit like bill payment.

Paytail Loan - Increase sales by 42%* by offering instant No Cost EMI

- Register in 30 seconds to offer instant finance and 0%* EMI

- Sell products from ₹3000 to ₹5,00,000

-Get settled with our commitment of up to 30 minutes*

-No monthly or annual fee

Paytail founder- Who is the co-founder of Paytail App?

The co-founder of this Paytail App is "Amit Kumar Chaturvedi" and "Vikas Garg", which is being run by these companies, with the help of which common customers can use their given services and very easily in less time. You can do transactions anywhere in a complete digital way.

[Funding Alert] BNPL fintech startup Petel raises $1.5 million in seed round

Paytail plans to achieve 10x-15x growth rate in monthly transactions over the next 12 months, along with using the funding to grow its product and build a strong team to transform the experience of offline buyers and sellers .

What is the purpose of this Paytail app?

Speaking on Capital Injection, Vikas Garg, Co-Founder, Paytail said,

“Since its inception, Paytail has been on a mission to create a level-playing field for both offline buyers and sellers, as the retailers in this segment face fierce competition from large e-businesses. We are trying to address the real pain points in the segment that contributes 95 per cent to India's retail sector, away from offering internet only to the current BNPL players. With this funding, we will be able to scale up the product and build a stronger team. We have a vision to become the largest retail BNPL fintech in India and we are working efficiently in that direction.”

Operating from April 2021, the New-Delhi based startup has a network of 10+ corporates, 25,000 merchants and over one lakh consumers within a short span of six months.

The tech startup is founded by Vikas Garg and Amit Chaturvedi, former associates of US-based SaaS fintech Unicorn.

“Since its inception, Paytail has been on a mission to create a level-playing field for both offline buyers and sellers, as the retailers in this segment face fierce competition from large e-businesses. We are trying to address the real pain points in the segment that contributes 95 per cent to India's retail sector, away from offering internet only to the current BNPL players. With this funding, we will be able to scale up the product and build a stronger team. We have a vision to become the largest retail BNPL fintech in India and we are working efficiently in that direction.”

Operating from April 2021, the New-Delhi based startup has a network of 10+ corporates, 25,000 merchants and over one lakh consumers within a short span of six months.

The tech startup is founded by Vikas Garg and Amit Chaturvedi, former associates of US-based SaaS fintech Unicorn.

Paytail App About?

Revolutionizing Offline Retail with Technology

There is a lot of untapped potential in the Indian retail sector when it comes to achieving growth. Petel firmly believes that technology can be a helping hand for retail and create the right environment for their success as well as place them equitably in the economic structure.

There is a lot of untapped potential in the Indian retail sector when it comes to achieving growth. Petel firmly believes that technology can be a helping hand for retail and create the right environment for their success as well as place them equitably in the economic structure.

Paytail is a fintech company that provides instant digital finance and easy EMIs to millions of merchants across the country. Our vision is to help consumers take their favorite products home with convenience and affordability.

Sample Credit Cost Calculation

For a ₹1,00,000 loan taken for 1 year, with interest rate @18% p.a.*, a consumer will pay:

1. Applicable Fee = 0

2. Monthly Payment (EMI) = INR 9168/-

3. Total interest payable for a period of 1 year = INR 10,016/-

4. Total cost of loan i.e. total amount to be paid later after one year = INR 1,10,016/-

*Interest rate varies based on user profile.

Paytail Website:

Official Site: Click Here

Paytail App Download:

Paytail App -Contact Us:

Feel free to contact support@paytail.com with any concerns or alternatively raise a support ticket from the app. Our team is going to make it a mission to solve all your concerns as soon as possible.

0 Comments

Please Do not enter any spam link in the comment box.