Perfr Credit Loan App - Get Instant loan under a Minute

Apply loan for Online Perfr Credit Loan App - Get Instant loan under a Minute , Without Paperwork 100% Paperless Document & Digital loan Process

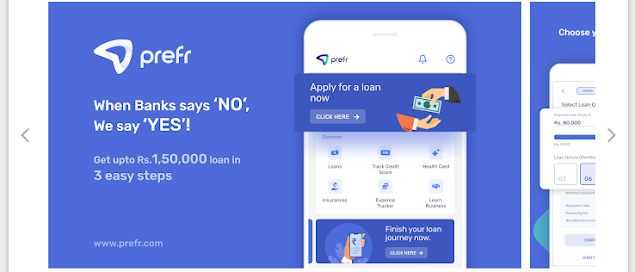

The Prefr Credit Loan App is an application through which you can avail instant loans to meet your small needs. If you want to take a business or personal loan, then it can be the only very special application through which you can sit at home. You can apply for a loan without going to the bank, if you want to take instant loans, then it is a matter of great pleasure for you that without going to the bank, now apply the loan by sitting at home and get the loan amount in your bank account immediately. In a few minutes, through this application, the loan amount can be taken for a maximum of Rs.1,500,000 lakhs, without doing paper work, you will get a minimum loan amount from ₹ 3,0000 to ₹ 1.50000, talk interest rate ranging from 2%. Interest can be charged at 2.66% according to the month, as well as processing fees from 2% to 3%, Perfr Credit Loan App - Get Instant loan under a Minute।

Perfr Credit Loan App - Get Instant loan under a Minute - PaperWork application is not required for applying loan through this application, all the processes have to be done digitally, to apply for the loan, you must have a KYC document like Aadhaar card to be given as address proof and ID proof. Normally you will have to provide PAN card, you will be able to take an instant loan on top of the KYC document, salary slip or bank statement will not be required to take a loan through this application.

You can check the credit score through the Prefer Credit Loan app, as well as take health card service, insurance, if you are a salaried person or a self-employed, then you can take the full Rs 1,50,000 from here. But the time to repay the loan is found from 1 month to 18 months, in which you will be able to easily pay EMI loan per months.

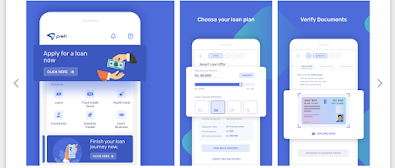

Through the Prefr Credit Loan app, you can complete the loan application in 3-step, like in the first place you have to choose a loan plan according to your own, after that the verification is done to your document, you get the repayment facility to see you once the verification Like how many months you want to pay the loan and how much EMI loan you want to pay per month, you have to set it according to which auto debit NACH registration has to be done so that your EMI loan will be paid to you every month. Auto-debit from bank account, Perfr Credit Loan App - Get Instant loan under a Minute

Perfr Credit Loan App - Get Instant loan under a Minute At Prefr, all the loans are financed by our lending partners - Fullerton India and Hero FinCorp

Get your loan approved in just a min 3 easy steps:-

1.Instant Check your loan offer

2.Verify Your Documents

3.Easy Repayment Facility Of Emi & Auto Debit ,Perfr Credit Loan App - Get Instant loan under a Minute

Important Highlight :-

1.Loan Finance Amount:- Minimum: ₹30,000, Maximum Upto ₹1,50,000

2.Loan Tenure: 3 months to 18 months

3.Interest Rate Charge:- Min 2% to Max 2.66% per month

4.Processing Fee Charge:- 2% to 3% ,

Perfr Credit Loan App - Get Instant loan under a Minute

We provide you with products that meet your personal and business needs, such as:

Credit Score: Learn your credit score and get tips to improve them

💊1. Health Card:- Have quality health accessible for your family with free medical services

💝 2.Insurance:- Get your Bima to protect you and your family from any harm

👨🏻💻 3.Term Loans for Self-Employed:- Flexible tenure loans that will help you grow your business

💸 4.Personal Loan for Salaried:- Comfort loans for your medical, home upgrade, wedding expenses ranging from 6 to 18 months with easy EMIs

💊1. Health Card:- Have quality health accessible for your family with free medical services

💝 2.Insurance:- Get your Bima to protect you and your family from any harm

👨🏻💻 3.Term Loans for Self-Employed:- Flexible tenure loans that will help you grow your business

💸 4.Personal Loan for Salaried:- Comfort loans for your medical, home upgrade, wedding expenses ranging from 6 to 18 months with easy EMIs

Prefr Credit Loan - Document Required*

If you want to apply for a loan through the Prefr Credit Loan app, then you should have important documents, in which you have to have KYC documents, provide Aadhaar card as address proof and PAN card as ID proof, if you have If you have a KYC document, then you can easily apply for the loan online through the loan loan app and get the loan amount instantly in your bank account, Perfr Credit Loan App - Get Instant loan under a Minute

1. Aadhaar Card. (Aadhaar card as address proof)

2. Pan Card. (PAN card as your identify Proof)

2. Pan Card. (PAN card as your identify Proof)

3. Photos or Selfie

What should be Prefer Credit loan App eligibility?

If you want to take a loan from the Prefr Credit Loan app, then you have to check your eligibility before applying the loan, within this application, if you are a citizen of India and you are above 18 years as well as your source of income. You can also apply for a loan, if you are a salaried person or self-employed, then you can apply for a loan through this app, Perfr Credit Loan App - Get Instant loan under a Minute

1. Must be Indian resident.

2. Above Age 18+ years old.

3. Proof of fixed income Sources.

2. Above Age 18+ years old.

3. Proof of fixed income Sources.

Prefr Credit Loan App : Benefits? Why Apply for Loan On Prefr Credit Loan App?

1. No credit history requirement for Loan.

2. Paperless & Online digital process Application.

3. Get 24*7 Customer Service Support.

4. Online Fast Application Review.

5. Instant Approval.

6.Fast Disbursement Loan Amount to your Bank Account.

7. Repayment Of loan On-time Get eligibility For Higher Loan.

8. Multiple Repayment Option.

1. No credit history requirement for Loan.

2. Paperless & Online digital process Application.

3. Get 24*7 Customer Service Support.

4. Online Fast Application Review.

5. Instant Approval.

6.Fast Disbursement Loan Amount to your Bank Account.

7. Repayment Of loan On-time Get eligibility For Higher Loan.

8. Multiple Repayment Option.

Perfr Credit Loan App - Get Instant loan under a Minute

How its work Prefr Credit Loan App?

1. Install the Perfr Credit Loan App through the Play Store.

2. Register To account.

3. Fill The Basic details and submit the application.

4.After submitting the loan application, a verification call will be received, the final application result will be shown in your application and will be informed by the SMS if your loan is approved.

5.loan agreement must be sign after the Loan approval and E- Mandate Registration Process Complete for auto-Debit Setup process ,

6. After signing the loan agreement, your loan approval amount is credited to your bank account and the notification is sent via SMS.

Perfr Credit Loan App - Get Instant loan under a Minute

Safe & Security Data:-

Perfr Credit Loan App - Get Instant loan under a Minute ,We encrypt the data you choose to share with us to protect your privacy.

Prefr Credit Loan Amount:-

Perfr Credit Loan App - Get Instant loan under a Minute Starting Loan Amount from Rs.30000 Upto Rs.1,50,000.

Perfr Credit Loan App - Get Instant loan under a Minute Starting Loan Amount from Rs.30000 Upto Rs.1,50,000.

Prefr Credit Loan Term:-

Perfr Credit Loan App - Get Instant loan under a Minute Starting Loan tenure Min 3 Months Upto Maximum: 18 Months.

Perfr Credit Loan App - Get Instant loan under a Minute Starting Loan tenure Min 3 Months Upto Maximum: 18 Months.

Prefr Credit Loan : For Example Loan Amounts:

Perfr Credit Loan App - Get Instant loan under a Minute

Loan Amount: Rs 100000

Tenure: 12 Months

p.m: 2% (on Reducing Principal Balance interest calculation)

the total Interest should be Rs.1,000,00 * 2% * 12 = Rs. 1,26,000

Tenure: 12 Months

p.m: 2% (on Reducing Principal Balance interest calculation)

the total Interest should be Rs.1,000,00 * 2% * 12 = Rs. 1,26,000

Processing Fee- Rs.2,000

Interest Rate - Rs.24,000

Total Amount rapaid after a year rs.1,26,000

How to Increasing Your limit Or Credit Score :-

As your credit score is improve to Prefr Credit Loan App, the amount will be increased and More various repayment methods will be unlocked With Offers. Hurryup ,

As your credit score is improve to Prefr Credit Loan App, the amount will be increased and More various repayment methods will be unlocked With Offers. Hurryup ,

Perfr Credit Loan App - Get Instant loan under a Minute।

Read about our terms and conditions here: https://prefr.com/terms_and_conditions

To know more information , visit www.prefr.com or mail to us at info@prefr.com

Apk file Download :- Click Here Perfr Credit Loan App - Get Instant loan under a Minute.

0 Comments

Please Do not enter any spam link in the comment box.