Piramal Capital & Housing Finance | Home Loan Housing Loan Piramal Capital | Piramal capital and housing finance Loan App

Piramal Capital & Housing Finance Limited is a non-deposit taking housing finance company headquartered in Mumbai with branches in major cities across India. DHFL was established to enable access to affordable housing finance for the low and middle income groups in semi-urban and rural parts of India.

Home loans up to 5-75 lakhs will be easily available

Piramal Capital and Housing Finance (PCHFL) Home Loan

Trust Piramal Housing Finance for highly flexible home loans with instant disbursal. Check your eligibility and apply now. Receive Rs. 90,000* INR cashback.

-Highlights

Rate of interest-

11.0% - 14.0% p.a.

Tenure-

up to 25 years

processing fee-

up to 2%

Loan amount-

Rupee. 5 lakh - Rs. 75 lakhs

prepayment fee

-Zero

foreclosure fee-

Zero

Piramal Capital & Housing Finance (PCHFL) Home Loan - Are You Eligible?

You must fulfill the following criteria to apply for this loan:

*Resident Type: Indian

*Applicant's Age: 21 - 75 Years

*Min. Monthly Income for Primary Applicant: Rs 12,000

Key Features of Piramal Capital and Housing Finance (PCHFL) Home Loan

Meeting your needs through our tailor-made products: Money Saver Home Loans - Up to 12 EMIs off for select customers when you repay your loan regularly at no additional cost. Affordable Home Loans - starting from Rs.5 lakhs onwards for salaried and self-employed customers who do not have any formal income documents or credit history. Griha Setu Home Loan - Higher loan eligibility for all borrowers with loans extended up to the age of 75 years. Super Loan - Up to 15% Low EMI for the first 5 years.

Loans as per local collateral types. ,

- No minimum education qualification or credit history required

- Loans for ready-to-move-in properties, under construction, plots, renovation, repair, expansion and balance transfer

- Faster loan processing through our digital loan platform

Housing Loan: If you also have a plan to buy a house or you are thinking of taking a home loan, then now Piramal Capital will also provide home loan facility to the customers.

Housing Loan: If you also have a plan to buy a house or you are thinking of taking a home loan, then now Piramal Capital will also provide home loan facility to the customers. Piramal Capital and Housing Finance Limited (PCHFL) has decided to provide home loans ranging from Rs 5 lakh to Rs 75 lakh to salaried and non-salaried customers.

Signed agreement with IMGC

Let us tell you that Piramal Capital and Housing Finance Limited (PCHFL) has tied up with India Mortgage Guarantee Corporation (IMGC) to provide this facility to the customers and to fulfill their dream of buying a home.

Know what is the company's plan?

Under this arrangement, IMGC will provide guarantee on a part of the loan. With this, it will be safe even in the event of default. PCHFL said in a statement on Wednesday that it aims to achieve 10 to 12 percent of its total business in 2022-23 through this partnership.

Company issued statement

The company said in the statement that the objective of this product 'Griha Setu Home Loan' is to meet the aspirational needs of salaried and self-employed customers.

Piramal Finance Personal Loan Kaise le | Piramal Finance Loan Review | Piramal Loan Apply kaise kare

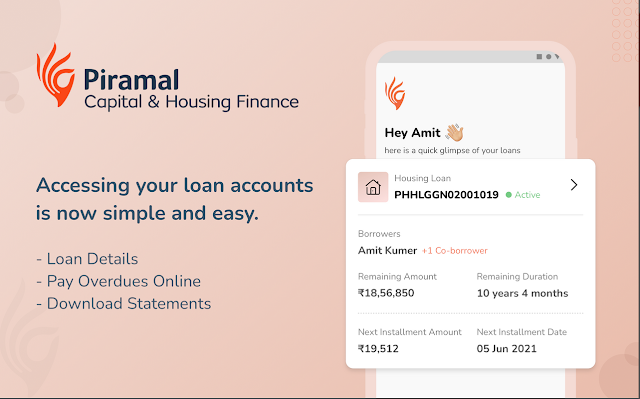

Welcome to Piramal Finance Limited (PFL) Mobile App!

Piramal capital and housing finance Loan App, PFL Mobile App is the one stop shop to access all the details related to your loan account. This mobile app is easy and convenient to use. Existing customers of PFL can login to this app using their registered mobile number.

Piramal capital and housing finance Loan App Features:

◼ Get access to all your loan accounts at one place

◼ Download Loan Statement, Final IT Statement, Provisional Interest Certificate

◼ Option to pay all your dues securely online

Piramal finance Loan App - personal loan products are flexible:

◼ Personal Loan Amount: ₹ 10,000 to ₹ 10 Lakh

◼ Personal Loan Interest Rates: Min. 11.99%* p.a., Max. 35.99%* p.a.

◼ Flexible loan tenure: 12 to 60 months

Loan Quote for an amount of ₹ 100000 (Example):

If you borrow a 12 month personal loan of ₹ 1 Lakh at a fixed rate of 12.00% with a processing fee of ₹ 999**, the monthly EMI will be ₹ 8,885.

**Excluding service tax and other statutory government levies.

Total interest payable on online loan: ₹6620

Total Payment (Principal + Interest): ₹106620

*Read Terms and Conditions

Piramal Retail Finance (PRF), a business unit under Piramal Finance Limited PFL, is a subsidiary of Piramal Enterprises Limited ('PEL', NSE: PEL, BSE: 500302). Focusing on small and mid-town India (the 'Bharat' market), the company offers new and expanded product offerings to meet the diverse financial needs of customers in India.

Piramal Retail Finance, the consumer lending platform of Piramal Enterprises Limited, is engaged in various financial services businesses. It offers home loans, loans for small businesses and loans for working capital to customers in affordable housing in Tier I, II and III cities and large affluent areas. Its modular structure will have the potential to add multiple products such as used cars, two-wheelers, education and purchase finance.

Focused on building strong partnerships, the company provides an Artificial Intelligence (AI) enabled multi-product retail lending platform for India's budget customers by augmenting the 'Digital at its Core' strategy through physical customer connect-points . Its vision is to reach out to the 'India' customer segment, especially those who do not have easy access to Indian financial systems, through its unique 'Hub and Spoke' model, comprising 14 hub branches and 26 technology-enabled spokes. Locations included.

Tag: Piramal Capital & Housing Finance | Home Loan Housing Loan Piramal Capital | Piramal capital and housing finance Loan App, piramal housing finance loan statement,

piramal housing finance rate of interest

piramal housing finance branches,

piramal finance personal loan,

piramal housing finance contact number

piramal housing finance login,

dhfl loan statement,

piramal personal loan apply online,

0 Comments

Please Do not enter any spam link in the comment box.